Payment Options

The City of Edmonton’s Property Tax Monthly Payment Plan allows you to pay your property taxes by pre-authorized automatic bank withdrawal and spread your property tax payments over the year.

- Download a personalized application through MyProperty

- Request an application online

- Call 311 (780-442-5311, if outside of Edmonton)

You may be able to add your property taxes to your mortgage payments. The mortgage lender through which you pay your mortgage can add your tax payments to your mortgage payment and submit payment to the City on your behalf. Many lenders offer this service to their mortgage customers.

The City sends you the original property tax notice for your records. The name of the mortgage lender being billed appears on your tax notice. Contact your financial institution to confirm that the payment is being made on your behalf.

Mortgage lenders submit payments by June 30. However, it can take up to 15 business days for the payment to show on your tax account. After the third week of July, check your property's transaction history or account balance report on MyProperty, our secure site for property owners.

You can pay taxes in full through your mortgage company.

In person at your financial institution

Before making a payment in person at your bank, confirm that your bank accepts "in-person paper payments" using the remittance portion of your property tax notice.

Some financial institutions will process payments at a teller only if their clients have been set up for online banking.

If paying at an ATM, keep your receipt as proof of the date and time of payment.

Online banking

When making your payment online, consult with your financial institution to ensure you are set up for online banking. Each bank has its own payment code for the City of Edmonton taxes. To confirm the correct payee name, contact your bank or 311.

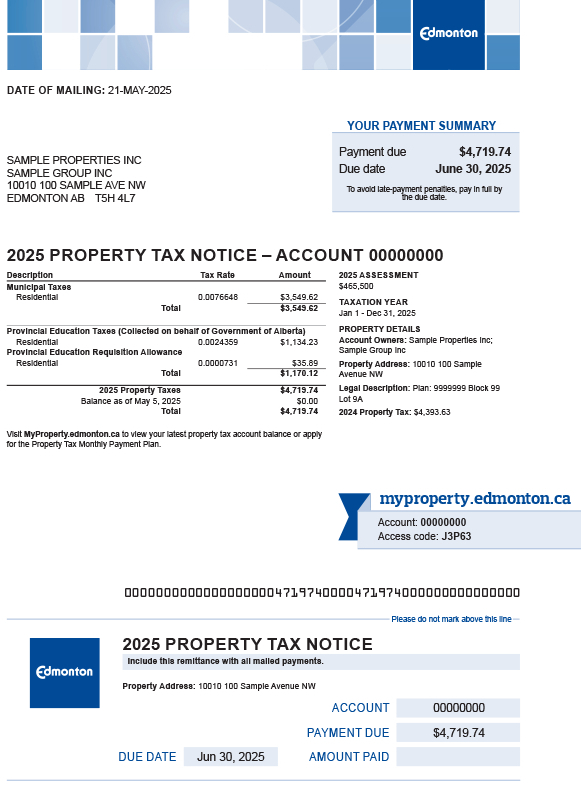

Link this payment code to the account number indicated on your property tax notice, particularly if you have purchased a new home.

If you own multiple properties, submit a separate payment to each account number indicated on your property tax notices.

Be aware of your financial institution's policy on the effective date and time of online payments to avoid late-payment penalties.

The City of Edmonton does not accept credit cards directly as a method of paying property taxes.

Several third-party online payment service providers offer a credit card payment option for the payment of property taxes. You may be able to use this option to pay property taxes to the City of Edmonton.

Note that these companies will charge you a transaction fee for this service. The City of Edmonton does not receive any of the transaction fee when this method of payment is used.

If you choose to pay property taxes through a third-party payment service provider, ensure you are fully aware of its policy on the effective date of payment. In some cases, it may take several business days for the transaction to reach the City.

You are responsible for making sure the City of Edmonton receives your payment by the due date. If your payment arrives past the due date for payment, you will be subject to late-payment penalties.

If you wish to pay taxes by mail, send a cheque or money order and the remittance portion of your tax notice to the following address:

City of Edmonton

PO Box 1982

Edmonton, AB T5J 3X5

When sending your payment by mail, allow ample time for the payment to arrive prior to the deadline. The envelope must be post-marked by Canada Post by the due date to avoid late-payment penalties. The City is not responsible if payments are not received.

Cheques that are incomplete or filled out incorrectly can not be cashed and will be returned. This may result in late payment penalties.

- Make it payable to the City of Edmonton

- Ensure the written amount is the same as the numerical amount, including cents

- Date and sign

- When paying for multiple properties, include payment remittance or a list of the accounts